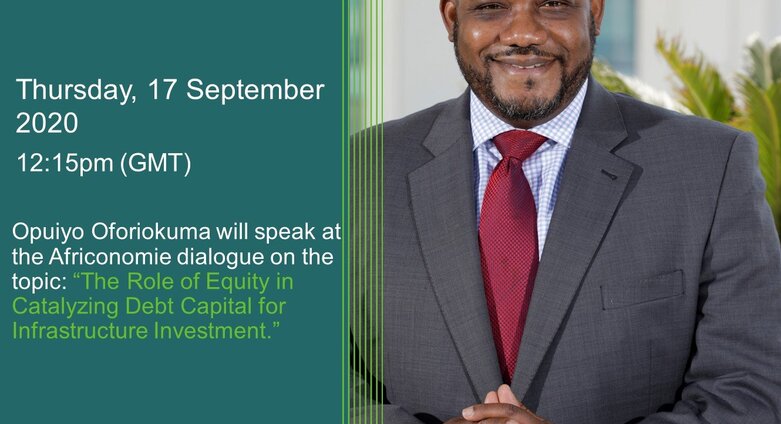

Africa50 Senior Director Explains How Equity Can Catalyze Additional Financing for Infrastructure

During a virtual Africonomie dialogue on Demystifying Infrastructure Debt Investments, Opuiyo Oforiokuma Senior Director for Strategy and Investor Relations, discussed the role of equity as a catalyst to develop and finance infrastructure. Other speakers on the panel included Stanley Austin, Partner, Africonomie, Professor Cledan Mandri-Perrott, Lead Faculty, and James Doree, Managing Director, Lion’s Head Global Partners.

The digital workshop was an introduction to infrastructure debt, including its benefits and risks, investor suitability for varying debt opportunities, and the performance characteristics of the asset class. The session showcased mechanisms such as enhancements that can minimize risk and thereby lower the barriers to private investment into infrastructure debt.

Background:

Private infrastructure debt has been a growing area of the market in recent years. On the demand-side, pension schemes, insurance companies and other institutional investors have been forced to broaden their investment horizons in the search for yield. Faced with the prospect of having to take on additional credit risk in this pursuit, it has become increasingly popular to instead turn to illiquid fixed income assets such as infrastructure debt. On the supply side, structural issues and regulation have led to a pull-back in lending by banks. Banking regulation is particularly unfriendly towards long duration or higher risk exposures. These trends have created an opportunity for institutional investors to step in and fill the void.

Investment into infrastructure debt provides pension funds, long term insurers and other institutional investors with the potential for long-dated high-quality cash flows which can be used to match liabilities, provide a yield enhancement over corporate bonds and diversify risk exposure. However, while investors in developed markets continue to increase their exposure to infrastructure debt, asset owners in Africa are still struggling to effectively invest in this asset class.

Catégorie: Événements