| countryCode | title | location | description | link | pinPoint | shareholder |

|---|---|---|---|---|---|---|

| cm | Nachtigal Hydropower Plant | Nachtigal Falls, Cameroon | Construction and operation of a 420 MW hydropower plant, under a 35-year concession. | /investing-for-growth/projects/nachtigal-hydropower/ | 460,430 | yes |

| eg | Scatec Egypt, Benban Solar Plants | Benban, Egypt | Construction of a 400 MW solar power plant. | /investing-for-growth/projects-investments/scatec-egypt-benban-solar-plants/ | 660,150 | yes |

| rw | Kigali Innovation City | Kigali, Rwanda | Development and Construction of a Technopark, commercial and residential spaces. | /investing-for-growth/projects/kigali-innovation-city/ | 670,545 | yes |

| sn | Malicounda Power Plant | Malicounda, Senegal | Development and construction of a 120 MW combined-cycle HFO power plant convertible to gas. | /investing-for-growth/projects-investments/malicounda-power-plant/ | 140,320 | yes |

| cd | Rail-Road Bridge (Pipeline project publicly announced) | Democratic Republic of Congo & Republic of Congo | Inter-Governmental Agreement signed for the development of a 1.575-kilometer toll rail-road bridge over the Congo River, linking Kinshasa and Brazzaville. | /investing-for-growth/projects-investments/bridge-linking-kinshasa-and-brazzaville/ | 500,520 | yes |

| cg | Rail-Road Bridge (Pipeline project publicly announced) | Democratic Republic of Congo & Republic of Congo | Inter-Governmental Agreement signed for the development of a 1.575-kilometer toll rail-road bridge over the Congo River, linking Kinshasa and Brazzaville. | /investing-for-growth/projects-investments/bridge-linking-kinshasa-and-brazzaville/ | 520,560 | yes |

| ng | Azura Edo | Azura Edo, Nigeria | Investment in the 461 MW Azura-Edo independent power plant. | /investing-for-growth/projects-investments/azura-edo/ | 380,380 | yes |

| sn | Tobene Power | Tobene, Senegal | Investment in a base load power plant platform with currently one operating asset, Tobene power plant. | /investing-for-growth/projects-investments/tobene-power/ | 140,320 | yes |

| ke | Kenya Transmission PPP Project | Kenya | The development, finance, construction and operation of power transmission lines in Kenya. | /investing-for-growth/projects-investments/kenya-transmission-ppp-project/ | 740,510 | yes |

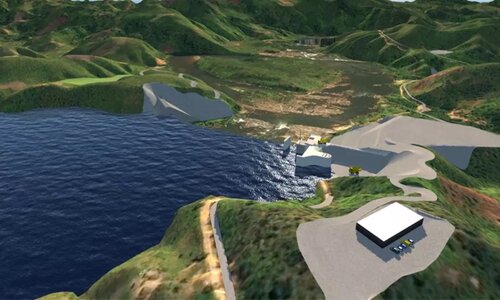

| mg | Volobe Hydropower Plant | Madagascar | Construction and operation of a 120 MW hydropower plant, under a 35-year concession. | /investing-for-growth/projects-investments/volobe-hydropower-plant/ | 870,770 | yes |

| ke | Poa! Internet | Kenya | Investment in an internet services provider providing wireless high-speed broadband to homes and SMEs in low income and semi-rural areas. | /investing-for-growth/projects-investments/poa-internet/ | 740,510 | yes |

| ke | PAIX Data Centers | Kenya | PAIX Data Centers develops and operates a growing pan-African platform of carrier-neutral colocation data centres. The company currently has operating assets in Ghana and Kenya | /investing-for-growth/projects-investments/paix-data-centers/ | 740,510 | yes |

| ke | Africa Healthcare Network | Kenya | Africa Healthcare Network (AHN) is the largest operator of dialysis clinics in East Africa. Since the opening of its first clinic in 2015, the company has been able to quickly scale, and now has over 45 clinics across East Africa, thanks to its "dialysis-as-a-service" business model. | /investing-for-growth/projects-investments/africa-healthcare-network/ | 740,510 | yes |

| gh | PAIX Data Centers | Ghana | PAIX Data Centers develops and operates a growing pan-African platform of carrier-neutral colocation data centres. The company currently has operating assets in Ghana and Kenya | /investing-for-growth/projects-investments/paix-data-centers/ | 290,390 | yes |

| ci | Scanning Systems | Côte d'Ivoire | Scanning Systems, is a company specialized in the design, financing, and implementation of One-Stop Joint Border Posts (JBPs) in Africa. | /investing-for-growth/projects-investments/scanning-systems-cote-divoire/ | 240,400 | yes |

| mz | Central Térmica de Ressano Garcia | Mozambique | Africa50’s second investment through a new baseload power platform called Azura Power Limited (APL). | /investing-for-growth/projects-investments/central-termica-de-ressano-garcia/ | 760,700 | yes |

| ma | Holged Group | Morocco | Holged is a leading provider of primary and secondary education operating in Morocco and Tunisia. | /investing-for-growth/projects-investments/holged-group/ | 210,90 | yes |

| tn | Holged Group | Tunisia | Holged is a leading provider of primary and secondary education operating in Morocco and Tunisia. | /investing-for-growth/projects-investments/holged-group/ | yes | |

| mr | yes | |||||

| ml | yes | |||||

| bf | yes | |||||

| ne | yes | |||||

| bj | yes | |||||

| tg | yes | |||||

| sl | yes | |||||

| gm | yes | |||||

| dj | yes | |||||

| mu | yes | |||||

| zw | yes | |||||

| eh | yes | |||||

| cv | yes | |||||

| mw | yes | |||||

| tz | Africa Healthcare Network | Tanzania | Africa Healthcare Network (AHN) is the largest operator of dialysis clinics in East Africa. Since the opening of its first clinic in 2015, the company has been able to quickly scale, and now has over 45 clinics across East Africa, thanks to its "dialysis-as-a-service" business model. | /investing-for-growth/projects-investments/africa-healthcare-network/ | 740,510 | yes |

| bw | yes | |||||

| ga | yes | |||||

Holged Group

Africa Healthcare Network